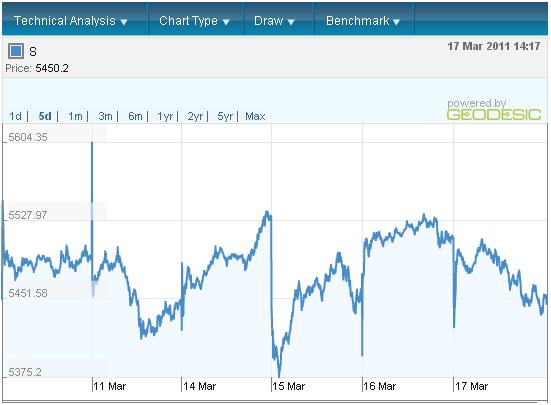

NIFTY Spot 5 Days Movement from 11 March 2011 to 17 March 2011

NIFTY Spot 3 Months Movement from Jan 2011 to March 2011

If we see the 5 Days movement of NIFTY Spot from 11 March 2011 to 17 March 2011 Its clearly indicates that NIFTY is too much volatile. But If we see the 3 Months movement of NIFTY Spot from Jan 2011 to March 2011 its clearly states that if NIFTY Spot gives closing above 5536 and sustains above these levels at least 3 Days then can touch 5700+ but breaks 5440 - 5448 - 5410 - 5400 these levels in the order and trades below these levels at least 3 days then can touch 5200 or can break 5200 - 5176.

So following Trading Strategy can be adopted at present situation :-

Buy NIFTY 5200 Put April Expiry @ Rs. 75 - 90 (according to risk level) + Buy NIFTY 5600 Call April Expiry @ Rs. 110 - 125 (According to risk level) + Short NIFTY 5800 Call April Expiry @ Rs. 40 - 50 (According to risk level) + Short NIFTY 5000 Put April Expiry @ Rs. 45 - 55 (According to risk level).

Kindly do 1 Lot everything.

But NIFTY 5200 Put April Expiry active @ Rs. 80, Buy NIFTY 5600 Call April Expiry active @ Rs. 115, Short NIFTY 5800 Call April Expiry active @ Rs.42, Short NIFTY 5000 Put April Expiry active @ Rs. 47/-

ReplyDeleteCall gave yesterday.....

Buy NIFTY 5200 Put April Expiry @ Rs. 75 - 90 (according to risk level) + Buy NIFTY 5600 Call April Expiry @ Rs. 110 - 125 (According to risk level) + Short NIFTY 5800 Call April Expiry @ Rs. 40 - 50 (According to risk level) + Short NIFTY 5000 Put April Expiry @ Rs. 45 - 55 (According to risk level).

BOOK PROFIT IN SHORT NIFTY 5000 PUT APRIL EXPIRY @ RS. 17.80, SHORT CALL GAVE @ RS. 47 ON 18 MARCH 2011.

ReplyDeleteBook Profit in Buy NIFTY 5600 Call April Expiry @ Rs. 133 - 140 (according to your risk level). Current Market price on 25 March 2011 at 13:04 PM Rs. 134.10. Buy Call gave @ Rs. 115 on 18 March 2011.

ReplyDelete