Today Nifty Fut Closed @ 6159.75 at premium + 23.9 of

Today Nifty Fut Closed @ 6159.75 at premium + 23.9 of and Spot closed @ 6135.85.

So, Resistance for NIFTY Fut - 6189.26, 6218.81, 6245.13

Resistance for NIFTY Spot - 6180.41, 6224.98, 6262.21

and, Support for NIFTY Fut - 6133.43, 6107.11, 6077.58

Support for NIFTY Spot - 6098.61, 6061.38, 6016.81

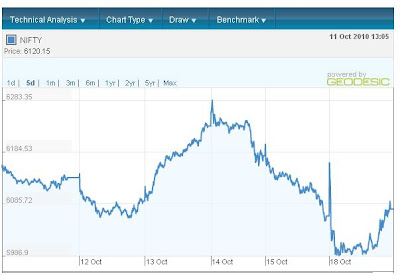

Last week Trading session shows that market is trying to touch the 6275 - 6300 and NIFTY have touched 6221.30 two times. So for further market is not looking below 6077.58 - 6061.38 by this expiry.

So we can take the following trading position in NIFTY Fut on the basis of Current level @ 6159.75.

1. Synthetic Long Call

2. Buy NIFTY Fut + Sell OTM Put

1. Synthetic Long Call means:-

BUY STOCK + BUY OTM PUT means Long Position in NIFTY Fut + Buy NIFTY Put Option

Buy NIFTY Fut @ Current Levels @ 6159.75 or buy between 6130 - 6170 according to your risk level + Buy NIFTY 6100 PUT@ Rs. 60 - 70.05 with the target of 6260-6275 with the stop loss of 6107.29.

In this trading call Put is buying to hedge the Long Position of NIFTY.

So the call is BUY NIFTY FUT @ 6130 - 6170 OR AT CURRENT LEVEL @ 6159.75 + BUY NIFTY 6100 PUT @ 60 - 70.05, TARGET 6260 - 6275, STOP LOSS 6107.29.

2. Buy NIFTY Fut + Sell OTM Put means:-

Buy NIFTY Fut @ Current Levels @ 6159.75 or buy between 6130 - 6170 according to your risk level + *Sell NIFTY 6000 Put @ Rs. 42.70, TARGET 6260 - 6275, STOP LOSS 6107.29.

*NIFTY is not seeking below 6000 by this expiry. So sell call is there to grab the guarantee income. IF NIFTY Close above 6000 the you will get Rs. 42.70, which is guarantee income.

So enjoy the Call.