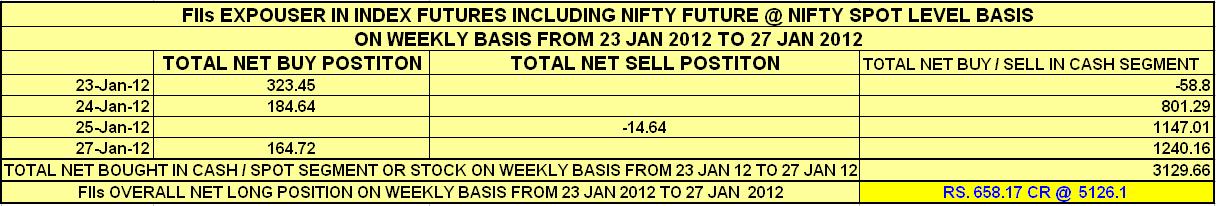

FIIs TRADING ACTIVITY IN NIFTY FUTURE ON NIFTY SPOT LEVEL BASIS ON WEEKLY BASIS FROM 23 JAN 2012 TO 27 JAN 2012:-

AFTER ANALYZING THIS TABLE IT IS CLEAR THAT FIIs ARE VERY POSITIVE ON UPSIDE IN THE MARKET. FIIs HAVE TAKEN LONG POSITION IN NIFTY FUTURE IN THREE TRADING SESSION OUT OF FOUR TRADING SESSIONS IN THE WEEK FROM 23 JAN 2012 TO 27 JAN 2012. THE NET LONG POSITION ON WEEKLY BASIS FROM 23 JAN 2012 TO 27 JAN 2012 IS RS. 658.17 CR @ 5126.10, IT IS NOT THE BIG AMOUNT OF LONG POSITION, BUT IF WE SEE ON 25 JAN 2012 AND 27 JAN 2012 THEN IT IS CLEAR THAT FIIs HAS BOUGHT VERY BIG AMOUNT IN CASH SEGMENT WHICH IS HIGHEST PURCHASE AMOUNT IN JAN 2012 TILL 27 JAN 2012 AND ALSO YEAR HIGHEST ONE ON 27 JAN 2012 RS. 1240.16, MEANS TO SAY FIIs ARE VERY CONFIDENT ON UPSIDE IN THE MARKET SO THEY ARE BUYING CONTINUOUSLY.

FIIs HAVE TAKEN LONG POSITION IN NIFTY FUTURE RS. 4739.49 CR @ 4897.27 NIFTY SPOT LEVELS BY THIS MONTH IN JAN 2012 TILL 27 JAN 2012, SO BECAUSE OF STRONG BUYING BY FIIs IN THE MARKET IN BOTH INDEX FUTURE SEGMENT AND SPOT SEGMENT MARKET IS NOT LOOKING DOWN. ON NEXT WEEKLY BASIS FORM 30 JAN 2012 TO 03 JAN 2012 NIFTY HAS VERY STRONG SUPPORT @ 5100 – 5130 BECAUSE FIIs HAVE LONG POSITION AS WELL AS HEAVY BUYING IN CASH SEGMENT ALSO.

DOLLAR IS ALSO DECREASING DAY BY DAY BECAUSE OF HEAVY INFLOW OF DOLLAR IN THE ECONOMY AND RESULTING RUPEE IS APPRECIATING DAY BY DAY BECAUSE OF HEAVY DEMAND FROM FOREIGN INVESTOR.

SO IF GETTING BUYING OPPORTUNITY AROUND 5130 THEN SHOULD BUY WITH STOP LOSS @ 5075 – 5100 ON SPOT BASIS. BUT WE SHOULD NOT FORGET PROFIT BOOKING ALSO POSSIBLE. SO IF NIFTY SPOT CLOSES BELOW 5100 IN CONTINUOUSLY THREE TRADING SESSION, THEN EXIT FROM LONG POSITIONS.

NIFTY SPOT HAS CROSSED THE 1ST MONTHLY RESISTANCE ON JAN 2012 SERIES BASIS @ 4971.98 AND FIIs LONG POSITION AVERAGE IS RS. 4739.49 CR @ 4897.27 ON JAN 2012 SERIES BASIS WHICH IS ABOVE THE NIFTY SPOT 1ST RESISTANCE LEVEL, SO NEXT RESISTANCE IS @ 5319.66. ON WEEKLY BASIS NIFTY SPOT HAS RESISTANCE @ 5274.10, IF IT HOLDS AND CROSSED THEN SURLY WILL TOUCH NOT ONLY THE 2ND MONTHLY RESISTANCE @ 5319.66 BUT 2ND WEEKLY RESISTANCE @ 5343.33 ALSO, BUT WE SHOULD BE VERY CAREFUL AT THIS LEVEL. HUGE PROFIT BOOKING IS EXPECTED BY FIIs AT THIS LEVEL.

BUY NIFTY FUTURE FEB EXPIRY ON DIPS @ 5130 – 5175 (ACCORDING TO RISK LEVEL), RISKY TRADERS CAN ALSO BUY AT CURRENT LEVELS CMP @ 5204.70, STOP LOSS @ 5085, TARGET @ 5285 – 5340.